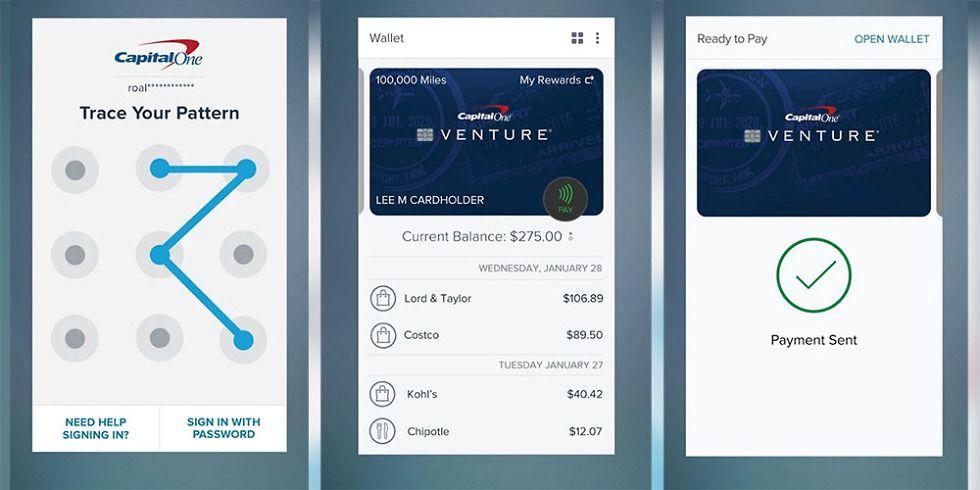

**Why More US Users Are Talking About the Capital One Mobile App** In a digital landscape where financial tools are evolving to meet daily needs with greater speed and convenience, the Capital One mobile app has quietly become a subject of growing attention. This app, trusted by millions, merges simple design with powerful functionality, aligning perfectly with shifting expectations for seamless banking in a fast-moving, mobile-first America. As users seek smarter ways to manage money on the go, the app’s focus on accessibility and security is sparking genuine interest across demographics. Driven by rising demand for financial transparency and effortless digital engagement, the Capital One mobile app sets itself apart through intuitive navigation, real-time account oversight, and proactive features tailored to modern financial habits. With mobile banking adoption accelerating, this app meets users where they are—on smartphones, during busy days, and across multiple financial touchpoints. ### How the Capital One Mobile App Actually Works The Capital One mobile app offers a comprehensive platform designed to keep users in control of their finances. After downloading and creating a secure profile, users can check account balances, view transaction histories, and initiate transfers—all with biometric login for added safety. The app supports instant bill payments, mobile check deposit using photo-enabled photos, and real-time alerts for spending and account activity, enhancing both convenience and awareness.

### Common Questions Customers Ask About the Capital One Mobile App **How secure is the Capital One mobile app?** Security is a top priority—every transaction is protected with industry-standard encryption, multi-factor authentication, and real-time monitoring, helping users stay protected as they manage finances on the go. **Can I manage all my accounts in one app?** Yes. The app consolidates checking, savings, credit card, and loan accounts in one interface, allowing seamless tracking of all financial activity from a single screen. **What tools does it offer for financial planning?** Users access easy-to-use dashboards with spending insights, monthly budget summaries, and goal-tracking features designed to encourage mindful money habits. **Does it support international transactions or foreign spending?** For users managing cross-border activity, tapping into specific financial products within the app provides tools to track foreign purchases and understand international fees clearly. **How responsive is the app during high-traffic periods?** Internal infrastructure ensures consistent performance, with optimized servers and streamlined processes maintaining fast load times even during peak usage hours. ### Opportunities and Realistic Expectations Many users appreciate how the Capital One mobile app simplifies complex banking tasks—turning tedious routines into quick, confident actions. While the app excels at transparency and convenience, it remains a tool among several available options; users should expect to combine it with account types, credit tools, or external services depending on their financial goals. The platform evolves continuously, but it doesn’t provide magic solutions—just reliable, user-focused infrastructure. ### Misconceptions That Matter Some assume the app offers instant credit or “get-rich-quick” features, but this is untrue—the app provides access, insight, and security, not guaranteed returns. Others worry about hidden fees; clarity comes through transparent pricing and detailed statement breakdowns directly in the app. By addressing these concerns upfront, Capital One strengthens user trust through honest communication. ### Who Benefits Most From the Capital One Mobile App While ideal for everyday bankers managing routine transactions, the app also supports students tracking expenses, remote workers balancing payroll and savings, and busy professionals wanting quick access without tedious steps. Its neutral design welcomes diverse financial journeys, placing control firmly in the user’s hands. ### Soft Call to Keep Exploring Staying informed about digital tools that simplify finance is a smart move—especially when choosing a platform built on transparency and real-world utility. Whether updating budgets, tracking spending, or exploring new features, the Capital One mobile app grows with your needs. Take a moment to learn more about what’s new, explore updates, or adjust settings—wise choices start with understanding what’s possible. Your financial future is best managed with tools that earn your trust, and this app continues to deliver on that promise through consistent, user-first innovation.

### Who Benefits Most From the Capital One Mobile App While ideal for everyday bankers managing routine transactions, the app also supports students tracking expenses, remote workers balancing payroll and savings, and busy professionals wanting quick access without tedious steps. Its neutral design welcomes diverse financial journeys, placing control firmly in the user’s hands. ### Soft Call to Keep Exploring Staying informed about digital tools that simplify finance is a smart move—especially when choosing a platform built on transparency and real-world utility. Whether updating budgets, tracking spending, or exploring new features, the Capital One mobile app grows with your needs. Take a moment to learn more about what’s new, explore updates, or adjust settings—wise choices start with understanding what’s possible. Your financial future is best managed with tools that earn your trust, and this app continues to deliver on that promise through consistent, user-first innovation.

Silent Heroes in Zero: The Unspoken Truth of Zenless Zone Characters

They Said It Was Waste of Time—Now It Snings Trilling Reviews Across Hollywood

Your Grocery List Just Got Scary—Publix Prices So High Publishers Hid Them