**How to borrow money from Cash App: A clear guide for users in the U.S.** Ever wondered how to borrow money from Cash App—especially when unexpected expenses hit or you want to grow your cash fast? The idea might sound surprising at first, but digital lending through fingerprint apps like Cash App is becoming a growing option for many income-driven, mobile-first Americans. With rising inflation, tighter credit access, and shifting financial habits, borrowing through peer-based or in-app systems is gaining real attention. This guide breaks down how borrowing from Cash App works—without hype, risks, or misleading claims. --- ### Why how to borrow money from Cash App Is Gaining Attention in the U.S. In recent years, many people are rethinking traditional banking, seeking faster, simpler alternatives. Cash App has evolved beyond peer-to-peer payments, now offering small online loans often with quick approvals and simple repayment formats. This shift aligns with a broader trend of younger, mobile-first users exploring non-bank financial tools for short-term liquidity. Concerns about credit gaps, slow bank processing, or interest from debt consolidation have pushed Cash App’s lending features into sharper focus as a convenient, accessible option—especially among users under 40 who prioritize speed and ease.

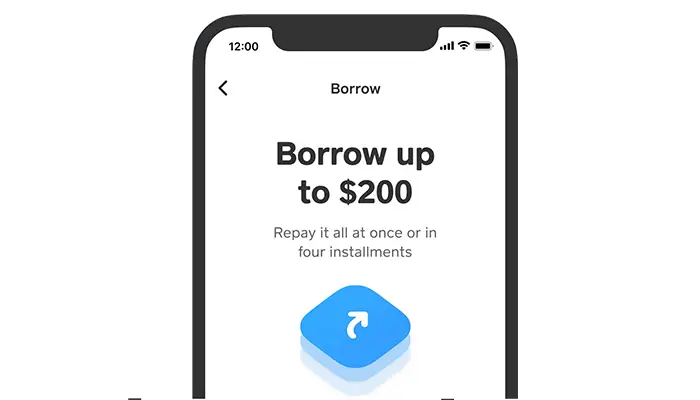

### How how to borrow money from Cash App Actually Works Borrowing from Cash App typically starts with a quick application through the app. Users enter basic info like income verification, bank details, and a short eligibility check—all completed digitally and often in minutes. If approved, cash is sent directly to your Cash App balance or transferable account within hours. Repayment plans are pre-set, usually with fixed monthly installments starting after a short grace period. All interactions are fully integrated within the app, with transparent terms clearly shown before signing. This process avoids lengthy paperwork and in-person visits, making it ideal for users seeking immediate funds—much like using Cash App for fast transfers, but with borrowing as a temporary financial support tool. --- ### Common Questions About how to borrow money from Cash App **How fast is the approval process?** Most users receive a decision within 15 to 30 minutes after submission, making it far quicker than traditional bank loans. **Do I need a credit check?** Cash App primarily uses income and transaction history rather than a credit score, opening access to those with limited credit history. **What interest rates are involved?** Rates vary by loan amount and repayment history; they’re generally competitive with peer-to-peer lending but require careful review. **Can I borrow small amounts for emergencies only?** Yes—borrow what you need for short-term needs, but repaid in fixed installments to avoid compounding debt. **Is the cash protected during borrowing?** Safe funds remain secure within Cash App and are not at risk unless repayments miss scheduled due dates. --- ### Opportunities and Considerations Borrowing through Cash App offers convenient access to cash when traditional credit is slow or unavailable. However, users should remain aware: repayment discipline is key to avoid late fees or impacts on app trust scores. The feature is designed for temporary liquidity, not a long-term financial solution. Realistic expectations—upfront and throughout—help users stay in control. --- ### Common Misunderstandings About how to borrow money from Cash App

--- ### Opportunities and Considerations Borrowing through Cash App offers convenient access to cash when traditional credit is slow or unavailable. However, users should remain aware: repayment discipline is key to avoid late fees or impacts on app trust scores. The feature is designed for temporary liquidity, not a long-term financial solution. Realistic expectations—upfront and throughout—help users stay in control. --- ### Common Misunderstandings About how to borrow money from Cash App Many assume borrowing from Cash App is like traditional credit with flexible approval. In truth, eligibility hinges on income stability and regular app usage, not just credit history. Also, repayment begins soon after approval—quick access doesn’t mean easy or risk-free borrowing. Others worry Cash App lending deposits are risky; in practice, funds are stored securely until repaid. Clarity here builds trust and better financial decisions. --- ### Who Might Be Interested in how to borrow money from Cash App? This option appeals broadly: recent graduates, self-employed freelancers, gig workers, or anyone balancing short-term cash gaps. Younger users, tech-savvy and time-pressured, find the integrated, mobile-first approach appealing. Small business owners or renters preparing for unexpected bills also explore it as a fast, transparent funding stream—without complex credit checks or lengthy approval wait times. --- ### A Thoughtful Soft CTA Understanding how to borrow money from Cash App empowers smarter financial choices. When considering a loan, always weigh your needs carefully, review terms fully, and track repayments proactively. Staying informed helps turn temporary options into lasting confidence—keeping your financial journey steady and secure. --- **Summary** Borrowing money from Cash App is a modern, mobile-friendly solution gaining traction in the U.S. amid economic uncertainty and rising demand for faster access. It offers quick, transparent funding based primarily on income, not traditional credit scores—but requires responsible repayment. Clear understanding of how it works, realistic expectations, and careful use position users to make sound choices. Stay informed, explore options thoughtfully, and use such tools when they align with your short-term financial goals. In a fast-changing financial landscape, knowledge remains your strongest tool.

Many assume borrowing from Cash App is like traditional credit with flexible approval. In truth, eligibility hinges on income stability and regular app usage, not just credit history. Also, repayment begins soon after approval—quick access doesn’t mean easy or risk-free borrowing. Others worry Cash App lending deposits are risky; in practice, funds are stored securely until repaid. Clarity here builds trust and better financial decisions. --- ### Who Might Be Interested in how to borrow money from Cash App? This option appeals broadly: recent graduates, self-employed freelancers, gig workers, or anyone balancing short-term cash gaps. Younger users, tech-savvy and time-pressured, find the integrated, mobile-first approach appealing. Small business owners or renters preparing for unexpected bills also explore it as a fast, transparent funding stream—without complex credit checks or lengthy approval wait times. --- ### A Thoughtful Soft CTA Understanding how to borrow money from Cash App empowers smarter financial choices. When considering a loan, always weigh your needs carefully, review terms fully, and track repayments proactively. Staying informed helps turn temporary options into lasting confidence—keeping your financial journey steady and secure. --- **Summary** Borrowing money from Cash App is a modern, mobile-friendly solution gaining traction in the U.S. amid economic uncertainty and rising demand for faster access. It offers quick, transparent funding based primarily on income, not traditional credit scores—but requires responsible repayment. Clear understanding of how it works, realistic expectations, and careful use position users to make sound choices. Stay informed, explore options thoughtfully, and use such tools when they align with your short-term financial goals. In a fast-changing financial landscape, knowledge remains your strongest tool.

You Won’t Believe What Happens When Zoom Turns Into Movie Magic

Download YouTube Without Watermarks—Truly Undetectable Method!

This Secret Yaoi Anime Bloom In Shocking Ways Only The Most Dedicated Fans Will Notice