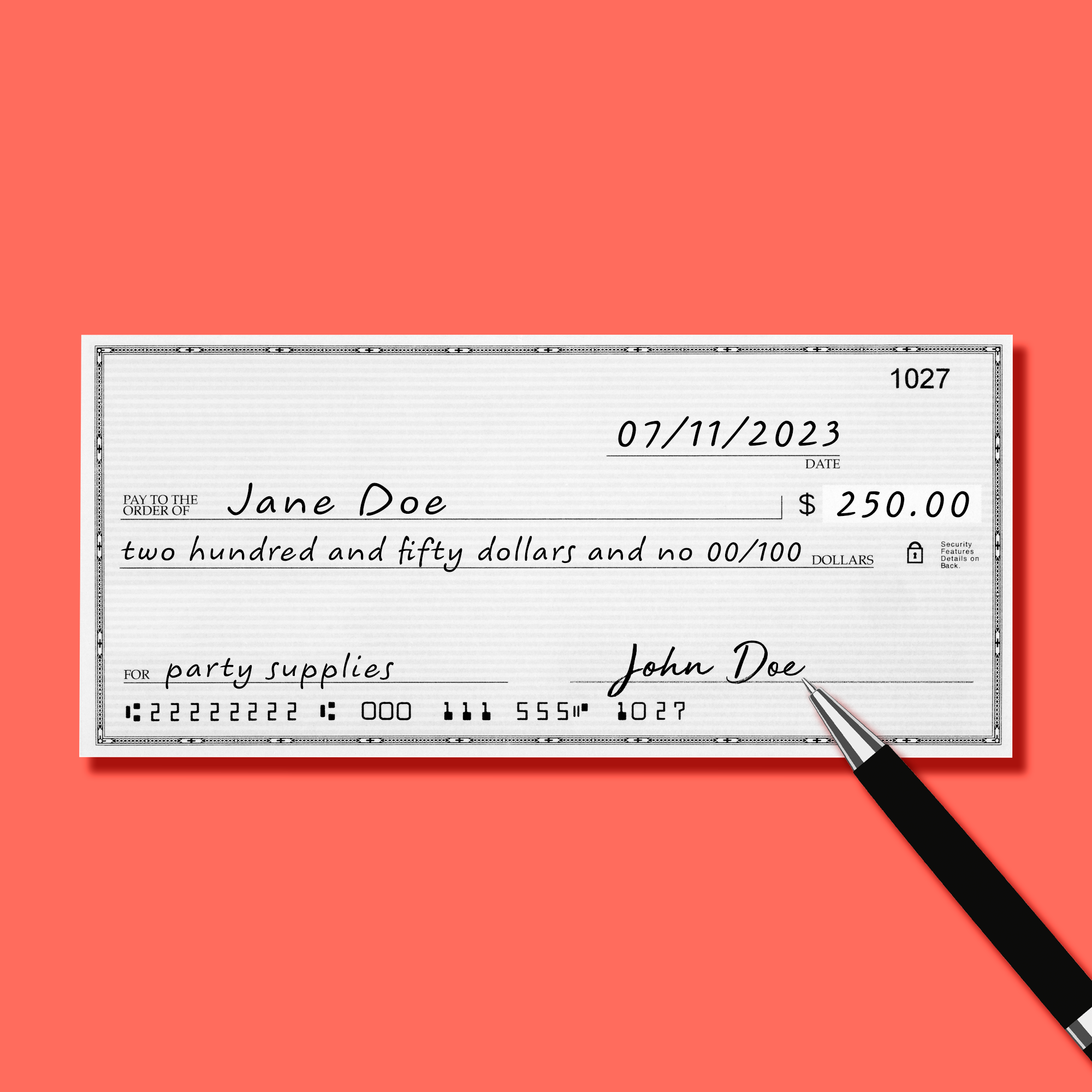

**How to Write a Check: A Clear Guide for Everyday Use** Curious why checking out paper payment methods still has relevance in a digital-first world? The simple act of writing a check remains a trusted tool for many in the U.S., not just for routine bills—but also for saving money, managing budgets, and balancing financial habits. Whether you’ve never written a check before or need a refresher, understanding the process builds confidence and keeps finance accessible. The process is straightforward and accessible. Start by filling in the date at the top right corner. Then, write the payee name clearly—this could be a business, franchise, or individual. Below that, clearly state the amount in numbers on the designated box, matching it exactly to avoid confusion. Always sign your full name beneath the payee line—the signature confirms the payment and completes validation. Nowhere should you use fictional names, vague terms, or substitute words—accuracy and clarity protect against errors or fraud in everyday use. Beyond mechanics, many users ask: “How does a check work?” A written check transfers funds from your bank account to the payee’s account using the bank’s clearing system, not instant electronic funds. Payouts clear over a few business days, relying on physical transfer processes gestated for over a century. This slow but secure delivery contrasts with digital methods, making checks relevant for privacy, record-keeping, and trust-building—especially for rentals, subscriptions, or large transactions. Common questions arise around corrections, suspended checks, or reporting lost ones. If an amount was written incorrectly, a mail-in correction ensures accuracy without invalidation. If the check is returned, timely reporting protects your account. Always sign legibly—partial or messy signatures can delay processing. Never endorse the back unless instructed, as it affects liability.

From budgeting and savings to landlord payments and gifting, knowing how to write a check offers real utility. It supports financial literacy and empowers users to control money flow beyond digital screens. With clear steps and mindful practice, writing a check stays a simple, safe action with enduring value. For those exploring secure and informed ways to manage payments, understanding this process builds long-term confidence. Whether used occasionally or regularly, the check remains a grounded financial tool—easy to learn, reliable in execution—forming part of a balanced, modern money strategy. Start confidently, check clearly, and keep your financial pace steady.

Zealthy Mastery: The Hidden Game Nobody Teaches Anyone

The Surprising Tricks No Yogi Knows About Yahtzee Score Card Strategy

Yahoo HK Exposes Its Dark Side – Begin to Understand What’s Really Happening Now