**M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience** In an era where digital financial transparency is gaining momentum, reports are emerging that M&T Bank’s online features hide unexpected costs, quietly increasing the true cost of everyday banking. With consumers increasingly aware of hidden fees and demanding clearer financial tools, M&T Bank Open Up has surfaced as a key headline in discussions about open banking and fair digital finance. Readers are curious: what hidden charges shape daily transactions, and why should users feel empowered to understand them? Recent conversations onスタッフmargin platforms spotlight how small, recurring fees—often invisible at sign-up—can accumulate, affecting budgeting and long-term financial health. M&T Bank Open Up practices reflect a broader trend where transparency gaps create unintended expenses for customers relying on online platforms. Understanding these dynamics helps users navigate digital banking more confidently and avoid predictable pitfalls. --- ### Why M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience Is Gaining Attention in the US

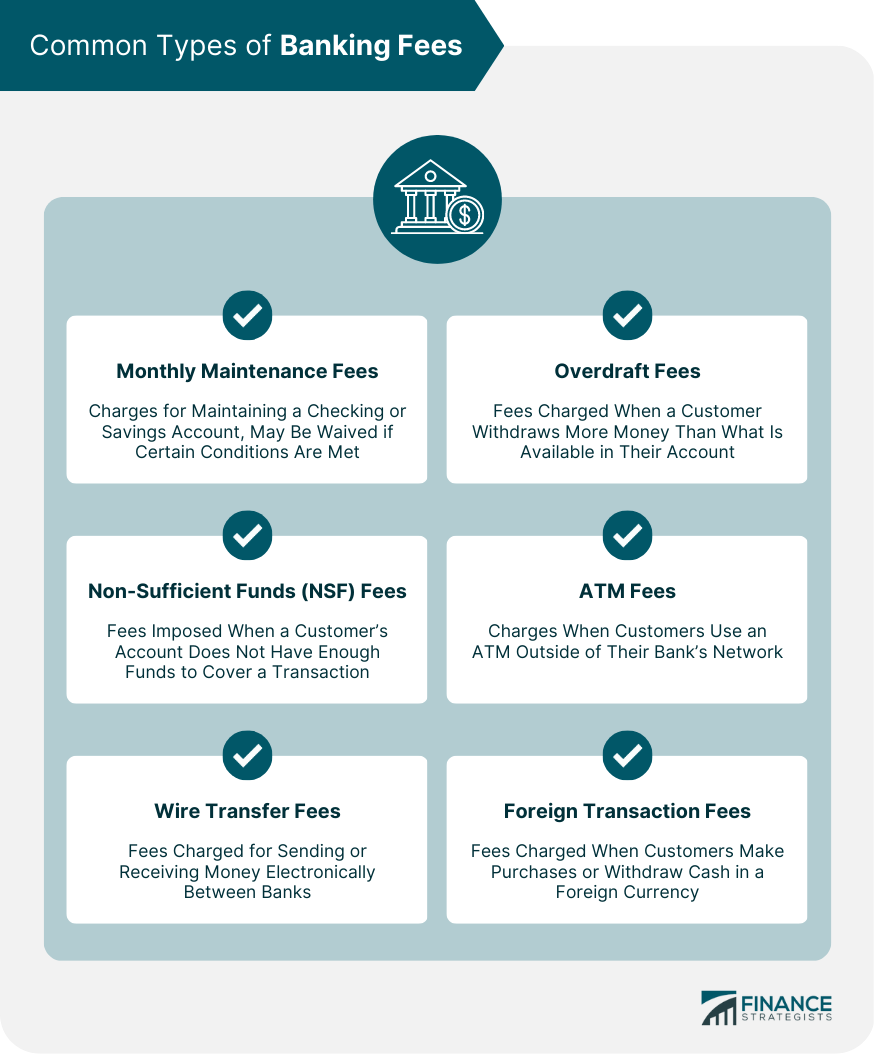

M&T Bank Open Up isn’t a single fee, but a set of policy mechanisms tied to account management, transaction volume, and card usage. These mechanisms, while designed to encourage responsible usage, can unintentionally inflate regular expenses for frequent digital bankers. Awareness is increasing, driven by user advocacy and investigative reviews—making this topic more relevant than ever. --- ### How M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience Actually Works Unlike abrupt, hidden charges buried in fine print, M&T Bank Open Up functions through transparent but complex rules applied during daily transactions. These features govern credits, debits, and account maintenance based on usage thresholds, promotional conditions, or service tiers. When these triggers activate, amounts deducted may appear unexpectedly—especially in online transfers, card payments, or balance transfers. For example, certain promotional rates require meeting daily transaction volumes, but failure to achieve them can result in hidden chargebacks or service suspension fees. Similarly, passing minimum balance requirements may generate occasional account maintenance deductions. These mechanisms exist to promote engagement and account vitality, but their cumulative impact can slow purchasing power—particularly for users relying on consistent, frictionless online banking. --- ### Common Questions People Have About M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience **Q: Are these fees obvious before signing up?** Most users aren’t alerted to specific Open Up charges during onboarding. Fees relate to dynamic thresholds and trigger-based triggers, making them easy to overlook at launch. **Q: How do Open Up charges affect monthly budgeting?** Because fees fluctuate with usage patterns, they create unpredictable costs that can disrupt budget forecasts—particularly for those managing tight cash flow. **Q: Can these fees be avoided entirely?** Full avoidance often requires avoiding certain transaction types or transaction volumes. However, users can minimize impact by monitoring usage and leveraging account alerts. **Q: Are these practices unique to M&T Bank?** No. Many digital banks apply similar usage-based models, though M&T’s fee structure is notable for its frequency and visibility within online banking interfaces. --- ### Opportunities and Considerations **Pros** - Encourages mindful banking habits through usage feedback - Promotes financial discipline via usage-linked incentives - Aligns with broader market shifts toward transparent digital pricing **Cons** - Can inflate total expenses without clear upfront warning - Risks confusing users unfamiliar with behavioral triggers - May discourage routine digital transactions if costs feel unpredictable

**Q: Are these practices unique to M&T Bank?** No. Many digital banks apply similar usage-based models, though M&T’s fee structure is notable for its frequency and visibility within online banking interfaces. --- ### Opportunities and Considerations **Pros** - Encourages mindful banking habits through usage feedback - Promotes financial discipline via usage-linked incentives - Aligns with broader market shifts toward transparent digital pricing **Cons** - Can inflate total expenses without clear upfront warning - Risks confusing users unfamiliar with behavioral triggers - May discourage routine digital transactions if costs feel unpredictable Realistically, M&T Bank Open Up reflects a balancing act: promoting engagement while managing operational sustainability. Users benefit from awareness but face nuanced decisions about how often to engage. --- ### Things People Often Misunderstand A common myth is that M&T Bank Open Up charges are predatory or hidden in ways impossible to track. In truth, costs emerge from threshold-based rules users can monitor—but their variability invites misinterpretation. Another misconception is that all flagged fees lead to constant hidden drains; many are minor or reversible. Recognizing these patterns builds confidence in managing online banking behavior, reducing anxiety tied to unpredictability. --- ### Who M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience May Be Relevant For This topic matters most for young professionals, small business owners, and frequent online savers who rely on digital platforms for daily transactions. Students managing part-time earnings, gig workers, and freelancers especially benefit from clarity on how usage thresholds affect disposable income. Small business owners using M&T’s business accounts should understand fee triggers to maintain cost predictability. While not limited to these groups, anyone spending over $50 monthly online sees the relevance and impact. --- ### Soft CTA Stay informed. Use secure banking apps mindfully—review transaction triggers and usage patterns to uncover hidden fees before they build. Explore review sites and community forums for real-user experiences and compare provider transparency. Understanding tools empowers smarter financial choices beyond the basics. --- **Experience is the best guide. Whether you’re balancing monthly budgets, growing a small business, or simply staying on top of digital finance, staying aware of how platforms structure charges helps you act with confidence. The path to financial clarity starts with awareness—especially in an age where hidden fees shape invisible costs.**

Realistically, M&T Bank Open Up reflects a balancing act: promoting engagement while managing operational sustainability. Users benefit from awareness but face nuanced decisions about how often to engage. --- ### Things People Often Misunderstand A common myth is that M&T Bank Open Up charges are predatory or hidden in ways impossible to track. In truth, costs emerge from threshold-based rules users can monitor—but their variability invites misinterpretation. Another misconception is that all flagged fees lead to constant hidden drains; many are minor or reversible. Recognizing these patterns builds confidence in managing online banking behavior, reducing anxiety tied to unpredictability. --- ### Who M&T Bank Open Up: The Hidden Fees That Hurt Your Online Banking Experience May Be Relevant For This topic matters most for young professionals, small business owners, and frequent online savers who rely on digital platforms for daily transactions. Students managing part-time earnings, gig workers, and freelancers especially benefit from clarity on how usage thresholds affect disposable income. Small business owners using M&T’s business accounts should understand fee triggers to maintain cost predictability. While not limited to these groups, anyone spending over $50 monthly online sees the relevance and impact. --- ### Soft CTA Stay informed. Use secure banking apps mindfully—review transaction triggers and usage patterns to uncover hidden fees before they build. Explore review sites and community forums for real-user experiences and compare provider transparency. Understanding tools empowers smarter financial choices beyond the basics. --- **Experience is the best guide. Whether you’re balancing monthly budgets, growing a small business, or simply staying on top of digital finance, staying aware of how platforms structure charges helps you act with confidence. The path to financial clarity starts with awareness—especially in an age where hidden fees shape invisible costs.**

Shocking Revelations From Yonutz That Will Leave You Speechless

You Won’t Believe What’s Hiding Between the Frames of These x Films

This WSFS Login Moment Will Send You Screaming Over Fraud You Didn’t See Coming!