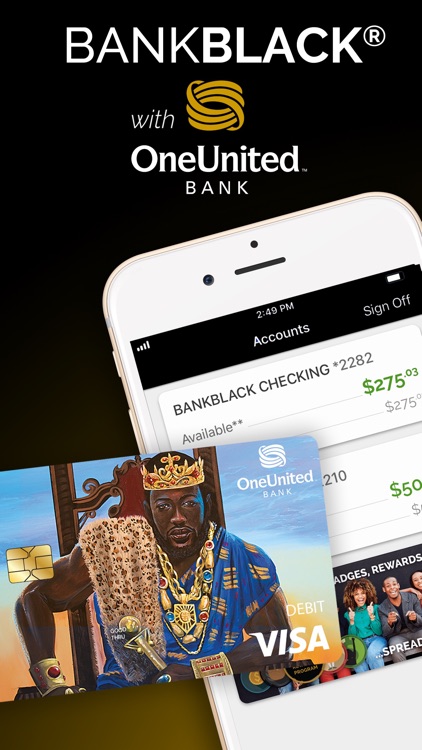

**The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today** Why are financial experts suddenly talking about one United Bank more than ever—especially as adoption of new services shifts the U.S. banking landscape? The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today isn’t just a rumor—it’s a quiet but transformative evolution behind the scenes. With rising consumer expectations and digital innovation accelerating across finance, many are watching closely how this institution is redefining trust, accessibility, and service in an increasingly complex economy. This growing attention stems from broader trends: banks nationwide are racing to integrate smarter, more user-centered systems that bridge traditional banking with emerging tech. Two key forces fuel this momentum: heightened demand for seamless digital experiences and the urgent need for inclusive financial tools that meet diverse customer needs. OneUnited Bank’s recent moves reflect this shift, positioning itself at the intersection of innovation and responsible growth. So what exactly is this unexpected force? At its core, The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today refers to strategic enhancements in digital infrastructure, customer engagement platforms, and hybrid financial solutions—delivered with a focus on accessibility and proactive service. These developments include advanced mobile applications with expanded features, partnerships aimed at financial inclusion, and internal systems designed to reduce friction in everyday banking tasks. Unlike flashy marketing or sudden operational changes, the transformation unfolds quietly but purposefully, driven by real user needs and long-term market shifts. The mechanics behind this change remain understated but potent. Behind the scenes, OneUnited is modernizing data-sharing frameworks, strengthening cybersecurity protocols to protect sensitive information, and embedding AI-driven tools to personalize financial guidance. These enhancements support a smoother, more intuitive customer journey—part of a broader push across U.S. banks to evolve from transaction processors to holistic financial partners. This alignment responds directly to consumer behavior trends: users increasingly expect real-time updates, customizable interfaces, and 24/7 support without compromising security or trust.

Yet, no transformation is without realistic expectations. While called “unexpected,” the shift builds on long-term investments and is part of an industry-wide reimagining—not an isolated pivot. Users might encounter asynchronous service delays during system integrations or temporary interface adjustments, but ongoing updates aim to reduce friction over time. Security remains paramount: rigorous encryption standards and multi-layered authentication are standard, protecting every interaction from initial login to transaction completion. For many, the relevance extends beyond routine banking. Small business owners benefit from integrated cash flow tools; students gain better budget management features; older users appreciate enhanced accessibility design. This real-world applicability underscores the force’s significance—not as a buzzword, but as a practical evolution in how major banks deliver value. To clarify misunderstandings, it’s important to note that The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today is neither a sudden collapse nor a speculative scam, nor tied to individual personalities or exclusivity. It reflects systemic innovation aimed at resilience, equal access, and responsiveness. The changes are operational, not persona-based—designed to serve broad customer segments, not concentrated user groups. Looking beyond individual benefits, this movement invites a broader reflection: what does modern banking truly mean today? Its future lies not in elaborate marketing, but in foundational improvements—better security, smarter tools, and unwavering commitment to user empowerment. The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today signals a quiet but deliberate realignment, where fundamentals drive progress and transparency earns trust. For users navigating this shift, staying informed means looking less for flashy headlines and more for consistent, user-focused updates. Watch how mobile interfaces evolve, engage with new educational resources, and explore tools that align with personal financial goals. The bank’s trajectory isn’t headline-driven—it’s rooted in long-term relevance, making it a reliable part of the evolving U.S. financial ecosystem. In a digital-first world, true innovation grows not from noise, but from essentials refined—The Unexpected Force OneUnited Bank Is Building in the Banking Industry Today is a smart case in point. It reflects patience, strategic vision, and a commitment to meeting evolving needs, one secure step at a time. Stay curious. Stay informed. That’s how progress takes root.

Can Zoup Solve Your Biggest Health Mystery? Discover Now!

This Simple Trick Will Sweep Every Fantasy Game This Week

The Silent Struggle Behind Workjam That IT Hides